How does the legal structure of my business affect my taxes?

In short:

- When starting, a new business must select a business structure, which will have both legal and tax implications.

- Sole Trader, partnerships, LLPs and LTD are the most common structures.

- Analyzing your business’s infrastructure and goals can help determine which structure will be the best fit.

Starting a new business is exciting. You get to build out your product, discover your potential market, choose a business location … and then you hit the legal portion. Your company needs to choose a business structure — and often, it all sounds like legal gibberish.

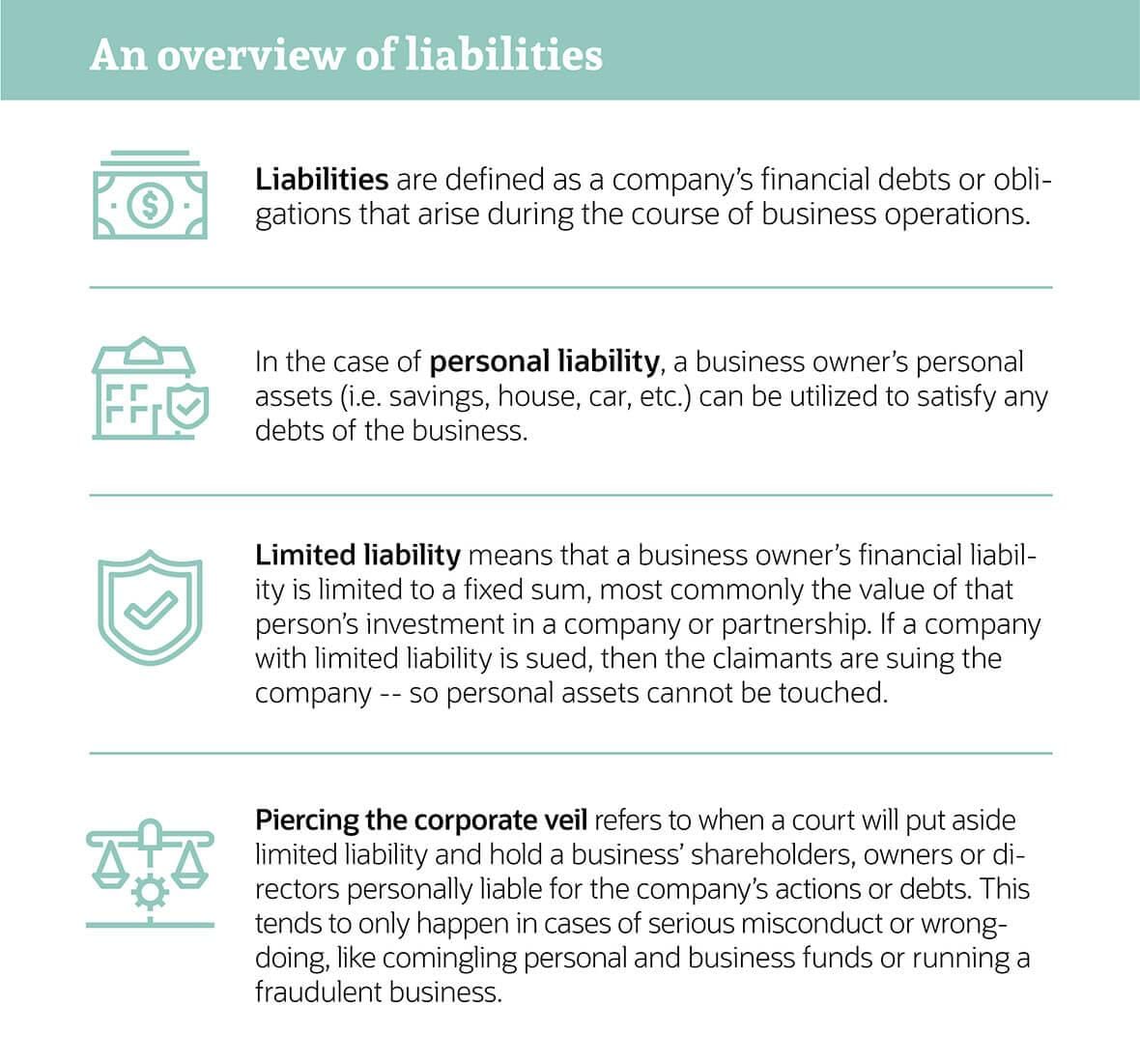

The choice of business structure is a monumental step for a new company. It can affect ongoing costs, liability and how your business team can be configured. This topic becomes particularly timely during tax season, as your business’ structure has direct tax implications.

Have no fear: Below, we outline the most common types of business structures and their respective tax ramifications.

What are the four types of business structures?

1. Sole trader

A sole trader is the most common type of business structure. As defined by the HMRC, a sole proprietor “is someone who owns an unincorporated business by himself or herself.” The key advantage of a sole proprietorship lies in its simplicity. Here, there is no distinction between the business and the individual who owns it — which means that the owner is entitled to all profits. However, it also means that the sole proprietor is responsible for all the business’s debts, losses and liabilities. This means that creditors or lawsuit claimants may have access to the business owner’s personal accounts and assets if the business accounts cannot cover the debt. Examples of a sole proprietorship include freelance writers, independent consultants, tutors and caterers.

In terms of tax implications, sole proprietorships are considered a “pass-through entity.” Also known as a “flow-through entity” or “fiscally transparent entity,” this means that the business itself pays no taxes. Instead, taxes are “passed through” to the owner, who pays them in their personal returns under ordinary income tax rates.

2. Partnership

In business structure, a partnership is “the relationship existing between two or more persons who join to carry on a trade or business.” Partnerships have three common types of classifications: a general partnership, limited partnership or a limited liability partnership.

- General partnership: Consists of two or more partners who share all liability and responsibility equally. This means the partners both take part in the day-to-day operations of the business. It also means that the partners are equally liable for any debts generated by the business. All partners are considered “general partners.”

- Limited partnership (LP): Has at least one “general partner” and one “limited partner.” A general partner assumes ownership of the business operations and unlimited liability. A limited partner, also known as a silent partner, invests capital in the business. However, limited partners are not involved in the day-to-day operations and don’t have voting rights and therefore have limited liability.

- Limited liability partnership (LLP): In this arrangement, all partners have limited personal liability, which means they are not liable for wrongdoings (i.e. acts of malpractice or negligence) committed by other partners. All partners in an LLP can be involved in the management of the business. It tends to be more flexible than the previous partnership forms because partners can determine their own management structure.

Like a sole proprietorship, partnerships are considered a pass-through entity when it comes to taxation. In many ways, a partnership is like an expanded sole proprietorship — but with the advantages and disadvantages that come with a partner. A partner can provide expertise, skills and capital for the business. But while they can affect the business positively, they can also impact it negatively. You should be comfortable with whomever you enter into business with.

3. Limited company

There are two types of limited companies: private limited companies and public limited companies. The former are often small businesses that don’t trade on the stock exchange, while the latter are usually well-known businesses that do.

Unlike sole traders and partnerships, these businesses are registered at Companies House and have their own legal rights and obligations. Ownership is divided into equal parts called shares. Anybody who owns one or more shares is a shareholder.

Limited companies offer limited liability – which means that the business, rather than its owners or managers, enters into contracts, employs people, takes debts and profits, and is liable to prosecution if criminal offences are committed. A limited company’s owner isn’t necessarily involved in the day-to-day running of the business unless they are elected to the Board of Directors.

What are the tax pros and cons of each business structure?

| Business structure | Tax pros | Tax cons |

|---|---|---|

| Sole trader | Pass-through entity Easy/inexpensive business structure to set up Minimal reporting requirements No corporate business taxes | Unlimited personal liability Difficult to get business financing No perpetual existence |

| Partnership | Pass-through entity No corporate business taxes Easy/inexpensive business structure to set up | Unlimited personal liability (depending on partnership classification) No perpetual existence Must create an official partnership agreement |

| Limited company | Minimising personal liability Professional status No corporate business taxes Tax efficiency and planning Separate legal identity Investment and lending opportunities | Accounting requirements are more complex and time-consuming Personal and corporate information will be disclosed on public record |

Other business structures

There are several other types of business, some of which must still be registered as one of the three business structures outlined above.

- Franchise – This is an already established company, such as McDonald’s, KFC and Hertz, which is owned by a franchisor but managed by a franchisee. The franchisor sells the right to use their business model to the franchisee, who pays an ongoing fee. Workload and start-up costs are usually lower, business finance is more easily acquired, and relationships with suppliers, distributors and marketers already exist. However, large ongoing fees restrict franchisees’ long-term profits, cheaper operating methods cannot be used unless sanctioned by the franchisor, and any negative action by a fellow franchisee may damage business.

- Freelancer/consultant – These individuals have the skills, knowledge and experience in a particular field to charge organisations for their services. The most common jobs for freelancing or consultancy include performing arts roles such as actor, dancer and musician. Media jobs, such as broadcast journalist, magazine journalist, writer and photographer. Other popular freelancing roles include acupuncturist, barrister, fine artist, osteopath, graphic designer, translator, interior designer, textile designer and web designer.

- Social enterprise – This type of business is operated to benefit society or the environment, and must transparently reinvest profits to achieve its objectives. There are around 471,000 social enterprises in the UK according to a recent government report, employing almost 1.44million people and contributing £60billion towards the UK economy. There are several types of social enterprise, most notably cooperatives, credit unions, development trusts, employee-owned businesses and housing associations. Two well-known social enterprises are The Big Issue Foundation and the Eden Project.

- Charity – While the trading arm of a charity can be classified as a social enterprise, the charity itself cannot. This is because it differs in the sense that income is attained through grants and donations, rather than trade. Charities pay reduced business rates and receive tax breaks, and are normally run by trustees who don’t themselves benefit from the charity.

The bottom line

Choosing a legal business structure is a critical step in your business’s lifecycle. It will affect everything from the ability to attract investors to personal liability to the paperwork involved.

Businesses should weigh their own personal circumstances and goals against the possible legal structures. Most importantly, all decisions should take into account expert advice from business and legal counsel prior to proceeding.